Money doesn’t just grow on trees. Once you’ve worked hard to build your wealth, you want to make sure it stays safe—that’s where asset protection planning comes in.

Life can throw curveballs—lawsuits, economic downturns, unexpected emergencies—and without the right protections in place, your hard-earned assets could be at risk. Asset protection planning helps you create strategies to shield your wealth from these unpredictable challenges, ensuring your assets remain secure no matter what life throws your way.

The good news? With a little foresight and some common-sense strategies, you can shield your finances from many threats. Asset protection planning helps you take proactive steps to safeguard your wealth. Here’s a practical ‘primer’ to walk you through no-nonsense, effective ways to protect your financial future from unexpected challenges.

Understanding the Risks to Your Assets

Before we dive into asset protection planning in Simi Valley, let’s first understand what you’re up against. Your assets—whether cash, property, investments, or business holdings—can be vulnerable to several threats. Effective asset protection planning helps you identify and guard against these risks, ensuring your wealth remains secure in the face of unexpected challenges.

- Lawsuits – Whether from business disputes, accidents, or even personal liabilities, lawsuits can drain your wealth quickly if you’re not prepared.

- Economic Downturns – Market fluctuations, recessions, or industry collapses can devalue your investments.

- Debt and Creditors – If you owe money, creditors can seize assets to satisfy debts.

- Medical Expenses – A serious health issue without proper insurance can wipe out savings fast.

- Divorce – A messy separation can mean splitting assets, sometimes unfairly.

- Fraud and Identity Theft – Cybercrimes and scams are increasing, and without proper precautions, you could be left with financial losses.

Understanding these risks is the first step in securing your financial future. Now, let’s look at what you can do to protect yourself.

Establish a Solid Legal Framework

1. Choose the Right Legal Structure

If you own a business or have significant assets, your personal wealth should be separate from your business holdings. Consider setting up a Limited Liability Company (LLC) or a corporation to protect personal assets from business liabilities. These structures create a legal barrier between you and potential creditors.

2. Utilize Trusts for Asset Protection

A trust is a legal entity that can hold assets on your behalf, shielding them from creditors, lawsuits, and even estate taxes. Some options include:

- Revocable Trusts – Useful for estate planning but don’t provide strong protection against creditors.

- Irrevocable Trusts – More robust protection, since assets in these trusts legally no longer belong to you, making them harder to seize.

3. Properly Structure Ownership

Consider joint ownership structures, such as tenancy by the entirety (available in some states for married couples), which can protect assets from creditors targeting just one spouse.

Insure Yourself Against Major Risks

Insurance may not be exciting, but it’s one of the easiest and most effective ways to protect your wealth. Some key policies include:

1. Liability Insurance

If you own a home, a business, or even just drive a car, liability insurance is crucial. It protects you in case someone sues you for injury or damages. Consider an umbrella policy to provide extra coverage beyond your standard policies.

2. Health and Disability Insurance

Medical bills are a leading cause of bankruptcy. Health insurance helps mitigate those costs, and disability insurance ensures you have income if an injury or illness prevents you from working.

3. Long-Term Care Insurance

Nursing home and assisted living costs are skyrocketing. Long-term care insurance is one way and can help prevent these expenses from depleting your assets. Believe it or not, cash value life insurance can be designed to provide the same benefits, and often with more advantages, i.e., you don’t lose it if you don’t use it, for example. In addition, policies can be designed to provide far easier access to benefits.

4. Business Insurance

If you own a business, protect it (and yourself) with business liability insurance, workers’ compensation, and key person insurance (which covers financial losses if a vital employee or partner passes away).

Diversify and Secure Your Investments

1. Don’t Put All Your Eggs in One Basket

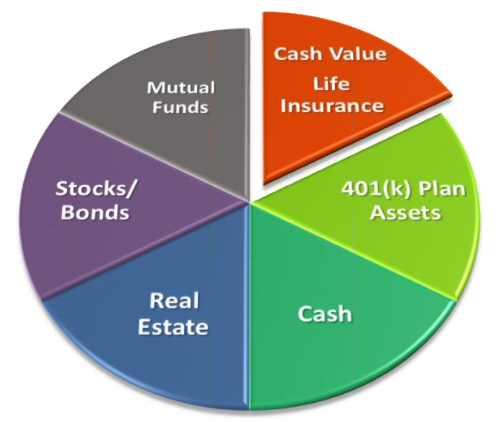

A diverse portfolio can help protect against stock market downturns. The key to effective diversification is something called reduced correlation, which can be achieved by spreading assets across different asset classes, such as:

- Stocks and bonds

- Real estate

- Precious metals and other hard assets

- Mutual funds and ETFs

- International markets

2. Be Cautious With High-Risk Investments

It’s tempting to chase high returns, but risky ventures can wipe out your savings. If you’re going to invest in volatile assets like cryptocurrency, speculative stocks, or startups, limit your exposure and balance it with safer investments.

Protect Your Digital and Physical Assets

1. Cybersecurity Measures

Identity theft and cyber fraud are growing concerns. Take these steps to protect yourself:

- Use strong, unique passwords for financial accounts.

- Enable two-factor authentication.

- Monitor your credit reports for unauthorized activity.

- Use encrypted digital wallets for online transactions.

2. Physical Security

For tangible assets like cash, gold, or important documents, consider:

- Home safes for smaller valuables.

- Bank safe deposit boxes for important papers and heirlooms.

- Keeping physical asset locations confidential from all but trusted family members.

Plan for the Unexpected

1. Estate Planning

Yes, asset protection also includes your estate! If something happens to you, what happens to your assets? Without proper estate planning, your wealth could end up in probate court, eaten away by taxes and legal fees. Key steps include:

- Drafting a will.

- Establishing power of attorney for financial and medical decisions.

- Setting up trusts for heirs.

- Reviewing beneficiary designations on retirement accounts and life insurance policies.

2. Emergency Fund

Unexpected expenses happen—job loss, medical bills, home repairs. Having an emergency fund with 3-6 months of living expenses in a liquid, easily accessible account can keep you from dipping into long-term savings.

Avoid Common Pitfalls

1. Ignoring Legal and Financial Advice

You don’t have to be an expert in law or finance, but having a trusted attorney and financial advisor can save you from costly mistakes.

2. Making Emotional Financial Decisions

Fear and greed can lead to poor investment choices. Avoid panic-selling during downturns or chasing get-rich-quick schemes.

3. Failing to Update Plans

Your financial situation changes over time. Regularly review and update your estate plan, insurance policies, and asset protection strategies.

Final Thoughts: Be Proactive, Not Reactive

Asset protection isn’t about being paranoid – although a little paranoia made be a good thing – it’s about being prepared. By taking common-sense steps—like structuring assets wisely, using the right insurance, diversifying investments, and keeping a security-first mindset—you can safeguard your financial future. The key is to act now, before problems arise. A little effort today can save you a lot of stress and money down the road.

What are your priorities? Let me know! I’ll be happy to help.

Jim