Bad Tax Planning begins when you believe your 401(k)/IRA statements

Effective tax planning is essential for reducing tax liabilities, especially when it comes to retirement accounts and Medicare premiums. Whether you live in Simi Valley or Florida, smart tax planning is critical to retirement success.

You might like my report, Four Steps to a Tax Free Retirement! Just tell me where to send it!

With rising tax rates and unpredictable costs in retirement, tax planning requires a careful, forward-thinking approach. Our team helps you plan for RMDs (Required Minimum Distributions) and capital gains tax to ensure you aren’t caught off guard by increased Medicare premiums and IRMAA surcharges

If you have $500,000 in your 401(k) or IRA, it’s not really $500.000. If you’re married and filing jointly, it’s more likely you could have $325,000 (35% tax bracket) or just $315,000 (37% tax bracket).

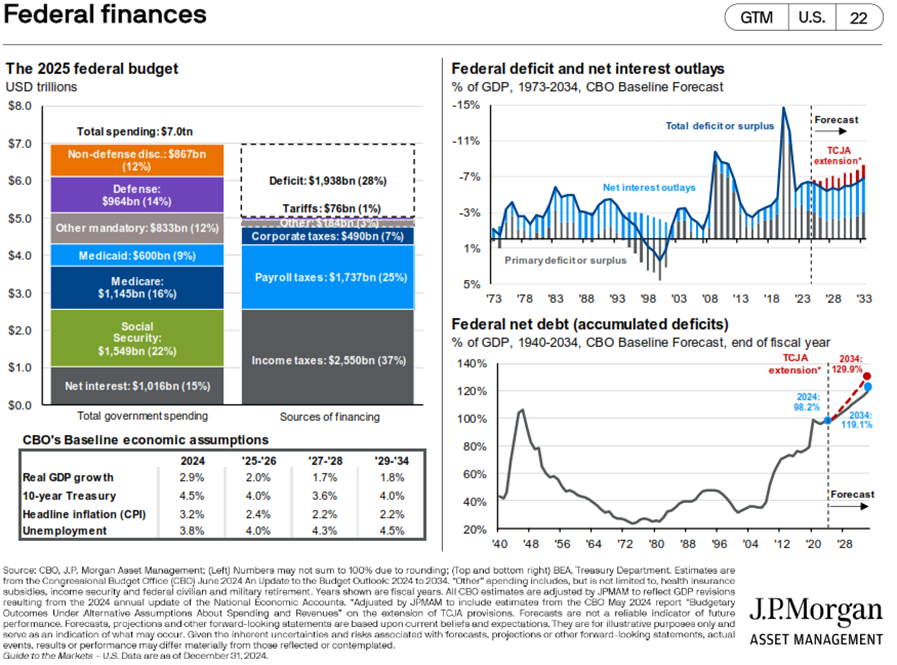

Tax deferred should read ‘tax delayed’. Do you know what taxes will be when you’re 73/75 and required by the I.R.S. to take distributions? Would you like to take a guess? Tax planning begins with understanding your situation – not just now, but 5, 10, 20+ years down the road!

It’s not only highly likely your accounts (and therefore your RMDs) will be much larger, but the tax rates may be much higher, too. And, of course, all this will impact the tax rates on your Social Security benefits – and those brackets aren’t adjusted for inflation; so, inflation alone will push many into higher Social Security tax brackets.

Oh yes, tax planning can’t ignore Medicare – those premiums are impacted, too.

Have You Met IRMAA? Understand How it Affects Your Tax Planning

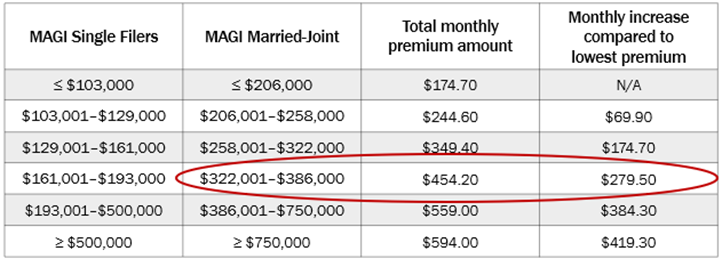

IRMAA, or “Income-Related Monthly Adjustment Amount,” is a monthly surcharge added to your Medicare Parts B and D premiums based on your income. This surcharge acts like a tax and only applies if your income exceeds $103,000 for single filers or $206,000 for married couples filing jointly.

Let’s break down what this means for you and how tax planning can help you avoid unexpected charges.

George and Martha, a high-earning married couple, are participants in Medicare Parts B and D. As part of their tax planning, it’s crucial to understand that IRMAA surcharges are based on income from two years prior. In their case, their modified adjusted gross income (MAGI) for the year was projected to reach $322,000, which triggers the IRMAA surcharge on their Medicare premiums.

For couples like George and Martha, strategic tax planning is essential to managing IRMAA and minimizing unexpected costs. Understanding how your income impacts your Medicare premiums can be a key part of smart financial planning.

On December 1, George, a high-earning individual, decided to sell a stock he had purchased in 2007 for $10,000. He sold it for $11,000, resulting in a $1,000 capital gain. This gain was taxed at the 15% long-term capital gains rate, along with an additional 3.8% net investment income surtax. The total federal tax bill for George was 18.8%.

This 3.8% surtax is another crucial factor in tax planning for individuals whose modified adjusted gross income (MAGI) exceeds $200,000 for singles or $250,000 for married couples. With effective tax planning, George could have better managed these taxes, ensuring that the impact on his finances was minimized.

So, George and Martha owe $188 of tax on the gain from their sale of the stock, right – 18.8% of $1,000.

Nope.

If a good definition of a tax is any cost that increases as your income increases, then George and Martha will owe more tax than $188 because the gain from the sale of stock pushed them off the Medicare IRMAA cliff, into paying higher Medicare premiums.

Look at this Part B IRMAA chart. That extra $1,000 gain pushed their AGI into the next premium tier that starts with $322,001.

So now, instead of owing $349.40 each for their monthly Medicare Part B premiums, George and Martha will owe $454.20 per month, an extra $104.80 per month, times two ($209.60), for an annual total in additional income-related monthly adjusted Medicare Part B premiums of $2,515.20.

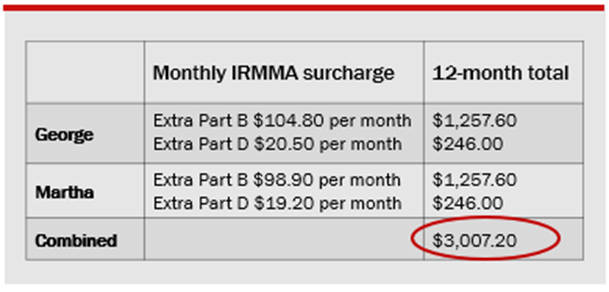

But it’s not over. Remember my mentioning Medicare Part D IRMAA charges are also impacted. George and Martha will each another $20.5 per month for their drug plans – an extra $492 for the couple over the course of a year. Adding all the IRMAA surcharges together for the year, George and Martha will each owe an extra $125.30 a month, or more than $3,000 of combined additional charges for the year!

All because of that $1,000 capital gain on the stock sale. Add the $188 they thought they’d pay and the total comes to $3,195.20. That’s a tax rate of 319.5% Yes, you read that right.

Let’s do a quick review:

- They sold stock for a $1,000 income gain

- The stock sale tax was: $188 (15% for long-term capital gains and 3.8% for the net investment income tax for high earners, for a 18.8% rate)

- The extra income from the stock sale triggers new IRMAA tiers

- The total IRMAA surcharges amounts for the year to $3,007.20 for George and Martha.

- So, the $1,000 extra income triggers taxes of $3,195.20—319.5% real tax rate!

So, is there a moral here?

Waiting to the end of the year to have your taxes “done” for you isn’t tax planning – it’s after-the-fact cleaning out the barn after the mess has been made.

Tax planning in Simi Valley, CA has to do with the arrangement of assets BEFORE you add-up the results for the I.R.S. That’s what financial planning is all about. Common sense stuff: getting ahead of things instead of waiting for the damage.

Need help? Tell me your priorities and arrange an online introductory call!

Let’s get your ducks lined-up!

Jim