Five Times When An Annuity Makes Sense

My recent blog posts, as well as on this platform, discussed the advantages of arranging assets early – ten years or more before retirement

My recent blog posts, as well as on this platform, discussed the advantages of arranging assets early – ten years or more before retirement

Last week we heard from many experts who believe it may be time to dump the 401(k). Two weeks ago we discovered that many experts,

Jim Lorenzen, CFP®, AIF® When most people think about estate planning, they think about protecting assets from estate taxation. But, most people aren’t worried about

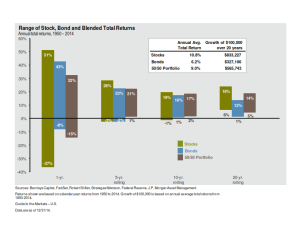

You’ve seen this chart. Advisors have been using it – or something like it – with clients and prospective clients for years. It’s supposed to

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.