Does the 4% Rule Still Work?

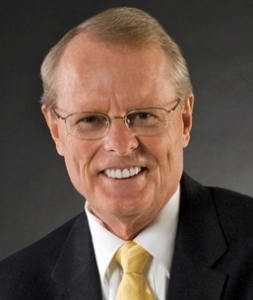

Jim Lorenzen, CFP®, AIF® Before you can take income from a nest-egg, you have to HAVE a nest-egg; but, getting there takes more than discipline

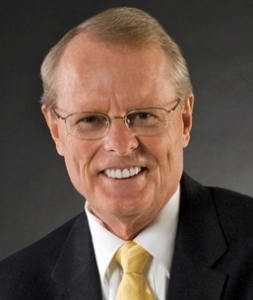

Jim Lorenzen, CFP®, AIF® Before you can take income from a nest-egg, you have to HAVE a nest-egg; but, getting there takes more than discipline

Enter Longevity Insurance– But Look Closely Before You Buy. You name the fear, the financial industry will come up with a solution to sell. These

Owners of closely-held businesses have long understood the value of insurance as a funding tool for executive retention, transition planning, and enhanced retirement benefits; but,

Did you know thatproperty transferred in excess of the unified credit equivalent will ultimately be subject to estate tax in the estate of the surviving

Tax brackets have an impact on your choice of funding insurance solutions to meet the needs of closely-held corporations and their shareholders! For example, a

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.