No Tax on Social Security Benefits?

We all love free money; and no taxes on Social Security sounds good! Hey, Social Security benefits weren’t taxed for many years!

We all love free money; and no taxes on Social Security sounds good! Hey, Social Security benefits weren’t taxed for many years!

It’s an election year, and while the headline topics dwell on the border, January 6th, the age of the candidates, and all the rest, few are talking about the “3rd rail” of politics: social security.

You can expect a few politicians will come up with innovative approaches (they know will never reach the floor for a vote), but it does make for good campaign sound bites. It can be confusing.

Social Security decision-making isn’t as easy as it was for our parents and grandparents. When they became eligible, they simply went downtown (remember those places?) and simply filed.

Not so easy today. Social Security decision-making has become more complex and, unfortunately, because of that, there are few ‘simple’ answers.

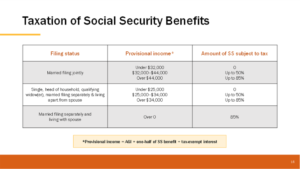

Social Security claiming decisions aren’t as simple as they may appear. The decisions you make for yourself can impact your spouse, your future taxes, and even the bite Medicare premiums take from your Social Security benefits.

There have been some changes to Social Security this year.

Have you tried to call Social Security lately? If so, this won’t come as much of a surprise – customer service is all but non-existent.

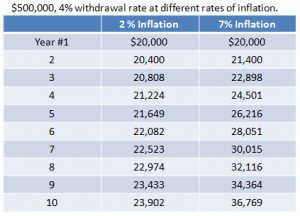

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.