Facing Retirement Account Rollover Decisions?

Believe it or not, you’ll have a number of options available to you – and it pays to do your homework before making decisions that could be irrevocable – and costly.

Believe it or not, you’ll have a number of options available to you – and it pays to do your homework before making decisions that could be irrevocable – and costly.

But Congress Could Provide the Wild Card. Roth accounts can be attractive, especially when viewed through the lens of our national debt and the possibility (probability?) of higher taxes in the future to fund that debt.

When it comes to building a solid financial future, finding the right investment vehicle can be a daunting task. Comparisons are often made between an IUL (Indexed Universal Life Insurance) and a Roth IRA (Individual Retirement Account) as a choice between getting life insurance or investing in the stock market. While an IUL can give the appearance of doing both; however that’s not really the case – and, often, this can lead to unrealistic expectations.

The SECURE Act 2.0 may do a lot to help secure Uncle Sam, but I’m not so sure about the rest of us.

RMD age hikes may not be the blessing you think. The question just might be who is more secure? Retirees or future government spending?

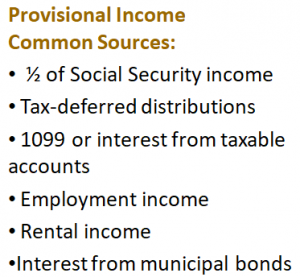

Tax traps are waiting. Did you it’s possible to be smack in the middle of the 22% tax bracket, yet taking an additional $1,000 in income could make that additional money taxable at 40%? It can happen to some taxpayers. In fact, there are other pitfalls many aren’t aware of, as well.

There may be times when a Roth conversion may be advantageous; but there are others when it may not be your best move.

Retirement Income Planning Gains Importance.

Rollover advice isn’t always straightforward – it’s often conflicted. There are issues you should address before you act.

Do you know what a systematic Roth conversion is? It’s worth knowing!

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.