To Roth or Not to Roth – Should You Do a Conversion?

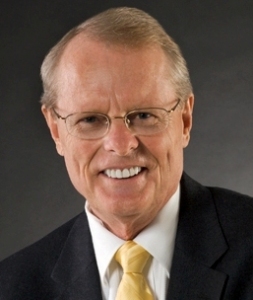

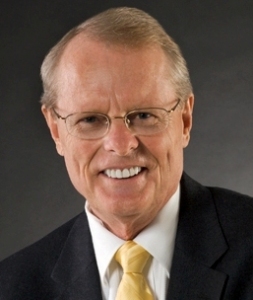

Jim Lorenzen, CFP®, AIF® Steven Elwell, a CFP® practitioner in Amherst, NY recently wrote a nice piece for NerdWallet on this subject. In his piece,

Jim Lorenzen, CFP®, AIF® Steven Elwell, a CFP® practitioner in Amherst, NY recently wrote a nice piece for NerdWallet on this subject. In his piece,

Jim Lorenzen, CFP®, AIF® First, let me state up-front that I AM a big believer in the power of life insurance, especially when designed as

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.