DOGE Wants to “Streamline” Social Security – That will be interesting.

The three largest expenses in the federal budget are Social Security/Medicare, interest on the debt, and defense.

The three largest expenses in the federal budget are Social Security/Medicare, interest on the debt, and defense.

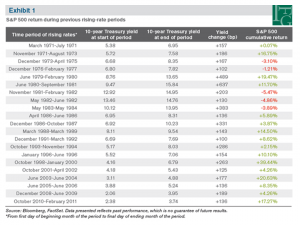

The Fed’s zero interest-rate policy (ZIRP) resulted in printing money. Quantitative easing (QE) seemed to work as the stock market saw it’s longest bull market in history.

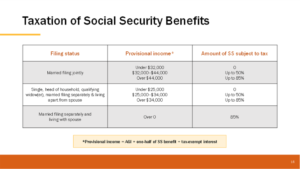

We all love free money; and no taxes on Social Security sounds good! Hey, Social Security benefits weren’t taxed for many years!

As you may or may not know, the Tax Cuts and Jobs Act is due to expire at the end of next year – just 16 months from now. The Biden Administration has proposed new tax increases worth knowing about.

If you are one of those asking the ‘will my money last’ question, there’s a way you can find out just what your probabilities are!

We all know the Fed target is 2% inflation; but, since COVID-19 and all the accompanying spending, it’s been tough going for the Fed. While the rate of inflation has been slowly declining, it’s still stubbornly around 3% – and with people living longer, it can still spell disaster for those facing retirement, especially with longer life expectancies.

Retirement milestones should actually begin the day you leave school and enter the workforce; but few people think about retirement at that age. They’re too busy starting careers. If they achieve early success, they won’t even be worried about retirement. It’s been my experience that it’s after age 50 they come through my door. By that time they’re done with stock tips and chasing rainbows. Age 50 has a way of making all of us start thinking.

Why are QLACs getting a attention now? Two reasons: (1) SECURE Act 2.0, and (2) rising interest rates.

When most people buy things, they see only the price tag; but that doesn’t reveal the REAL cost, especially when it comes to luxury items. The real cost of luxury can be more than they realize.

It’s an election year, and while the headline topics dwell on the border, January 6th, the age of the candidates, and all the rest, few are talking about the “3rd rail” of politics: social security.

You can expect a few politicians will come up with innovative approaches (they know will never reach the floor for a vote), but it does make for good campaign sound bites. It can be confusing.

Back in the 1990s, taxes and fiduciary standards weren’t talked about. The financial headlines were dominated by star fund managers and double-digit growth stories. Financial talk shows and glossy magazines alike obsessed over who was “beating the market.” The mantra was simple: accumulate assets. That was the measure of success.

What most people don’t realize: There are some important details about how and when these delayed credits are actually added to your benefit.