The Seven-Step Financial Planning Process

Are you over age 50 and concerned about your future? Do you need help? The financial planning process is really a road map designed to help you on the way to your goals.

Planning for retirement income and wealth preservation in the face of inflation and taxes requires some thought. You can begin your planning process easily. Just go to the GETTING STARTED tab!

Here are some questions worth pondering:

- Will your retirement income last to life expectancy for two people?

- How will your next major purchase or repair impact your retirement planning for two decades from now?

- Does your financial plan include an investment policy statement that provides a roadmap for your long-term investments?

- Was your retirement plan the result of a collaboration with a CERTIFIED FINANCIAL PLANNER® professional, or a “boiler plate” presentation from a product salesperson?

- Are you getting your advice from a broker or a Registered Investment Advisor

Technology today has leveled the playing field for investors. While access to sophisticated planning and institutional management – once was the exclusive domain of the old `big-name’ bricks-and-mortar firms – technology has leveled the playing field, allowing investors greater access while still utilizing the guidance of independent, non-conflicted service providers who don’t operate in a sales environment.

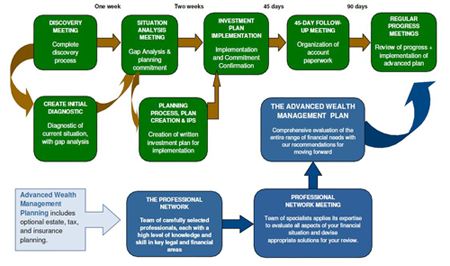

The Planning Process – How it works:

Click on the graphic above to see the PDF

The CFP® Board’s Seven-Step Planning Process:

1. Understanding Your Personal and Financial Circumstances

Any plan is only as good as its input. We begin with gathering all relevant information required to help you meet your goals. In addition to your financial information, we also work with you to analyze your current situation and address incomplete information.

2. Identifying, Selecting and Prioritizing your Goals

We all have needs, wants, and wishes. “Getting the ducks lined-up” helps when it comes to making sure the important things don’t get neglected.

3. Situation/Needs Gap Analysis

Your current portfolio is analyzed for risk and a `stress test’ analysis is performed to see how a similar asset allocation would have performed during different historical periods revealing best/worst case scenarios which help calculate success probabilities, taking taxes, inflation, portfolio inflows and outflows. We’ll also analyze potential alternate courses of action.

4. Data Review and Construction of a Financial Action Plan

We then review our findings with you and discuss alternative approaches for fulfilling the Action Plan. Review/Refinement of Action-Plan.

5. Review/Refinement of Action Plan

This is the search, screening, and selection process to refine the investment/manager mix to fulfill your objectives in a manner consistent with your profile, gap analysis, and plan criteria.

6. Plan Implementation

Once you’ve approved the plan and selections have been finalized, implementation is largely an administrative process. We prepare and process the appropriate paperwork, facilitate asset transfers, set-up monitoring procedures, and coordinate efforts with your accountant, attorney, and other advisors as necessary

7. Monitoring with Reviews and Revisions

In addition to regularly scheduled review meetings, plan performance is routinely monitored and you can expect communication from IFG throughout the year, including performance, updates, newsletters, etc. Complete information is also available 24/7 via the “Clients Only” portal of our website.

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® and an ACCREDITED INVESTMENT FIDUCIARY® based in Simi Valley, California, also serving clients across the United States. To arrange an introductory phone call, just use our convenient scheduler!