Additional Information: What fees will I pay?

Additional Information: What fees will I pay?

All IFG planning and investment advisory fees are fully disclosed and explained in writing with all questions answered before you enter into a planning or advisory agreement. You will also be given a copy of my privacy policy and my written Fiduciary Oath.

The concept behind the IFG fee structure is simple: Ongoing services, i.e., financial planning and investment advisory services, use an ongoing compensation model. Processes requiring few or no ongoing services, i.e., life insurance, are not charged ongoing fees and use a single compensation model. All fees are clearly explained in all IFG proposals and are mutually agreed upon prior to you becoming a client.

Compensation Breakdown:

Financial Planning and Investment Advisory Fees:

I. Your Initial Financial Plan:

(a) The first step: Learning about you. The formal term is “Gap Analysis”, but it amounts to the same thing. This is where we gather all information about your current situation, as well as your priorities, views, and goals. Retainer: $750.

(b) The second step: Financial Planning. This is a collaborative process and could take several meetings, either in-office or online (your choice). A completed financial plan is a requirement for becoming an IFG investment advisory client, this initial planning fee is quoted on a defined-project basis. You will receive a written proposal with everything clearly spelled-out.

II. Ongoing investment advisory services with financial plan reviews and updates.

The two components of financial planning and investment advisory services go hand-in-hand at IFG and compensation for each depends on the size and complexity of each case and is based as follows:

- Assets Under Advisement (AUA) – $500,000 minimum.

Plan review component: A separate fee for subsequent financial planning review and update services is charged for ‘held-away’ assets only (those not covered by an IFG investment advisory agreement) with IFG’s planning fee discounted equal to the percentage of the client’s total financial assets placed through the services of IFG. Example: If 75% of your financial assets are placed through IFG, your fee for the ongoing planning reviews concerning ‘held-away’ assets is discounted at 75%. Obviously, if 100% of assets are placed through IFG, there is no separate fee for reviews and updates. This structure ties IFG’s compensation not only to portfolio performance, but also to cost efficiency.

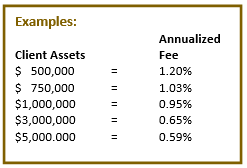

Investment advisory component: Advisory fees are paid according to the investment advisory fee schedule (below) which encompasses all ongoing financial planning review and update meetings and services for assets placed through IFG, including investment advisory services, encompassing ongoing due-diligence, monitoring, and client education. The investment advisory fee is asset-based and automatically deducted on a quarterly basis in accordance with IFG’s investment advisory fee schedule by the custodial firm and fully disclosed. Advisory fees typically range from 0.55% to 1.20%.

IFG’s investment advisory fee schedule**

Annual investment advisory fees are computed based on asset balances and deducted on a quarterly schedule by the asset custodian (IFG does not take custody of client assets). Quarterly fee deductions are fully-disclosed in advance and on client statements. IFG does reserve the right to waive the $250,000 asset minimum in certain instances.

| Investment Management Advisory Asset Based Fees1 | |

| On the first $500,000 | 1.20% |

| On the next $500,000 | 0.70% |

| On assets above $1 million | 0.50% |

As you can see, as your asset size increases, the fee percentage declines.

Points worth noting:

- Please keep in mind that all fees are subject to adjustment based on each client’s unique circumstances and goals. IFG’s working arrangement will be provided to you in writing after a needs/gap analysis has been completed.

- Asset Custody: IFG does NOT take custody of client assets. Accounts will be in your name (or trustee you designate) at an independent third-party custodian, most often Pershing/Bank of New York-Mellon. IFG has no access to client funds. All fee billing services are provided by independent third-party providers in accordance with clients’ written instructions contained in IFG’s investment advisory agreement.

- Referral Compensation Arrangements: IFG does not pay or receive compensation, or any other material economic benefit, either directly or indirectly, involving any third party professional or individual for recommending the selection or retention of professional services for a client. IFG may, from time to time, utilize the services of a third-party referral service who is paid in order to provide compensation for marketing expenditures.

- Insurance services: There are some instances, as noted above, where ongoing advisory fees would seem inadvisable. For example: “fixed” insurance products generally do not require continuous or ongoing manager due-diligence, oversight, and portfolio review – therefore it would seem inconsistent to charge ongoing advisory fees. Examples would include the placement of life insurance or fixed annuities, generally used when estate protection, charitable giving, or other needs when insurance products are either the only logical tool or an appropriate supplement available in the “financial toolbox”. Insurance is provided under California license #0C00742. In California, licensed agents are not allowed to charge fees for insurance placement and non-licensed professionals are not allowed to provide guidance on specific policies.

Financial planning fees can be paid by bank ACH or credit card and monthly or quarterly subscription fees can be arranged for certain services.

All fee arrangements, however, do contain inherent conflicts of interest. I’ve addressed these here. Of course, if you have any questions, you can arrange a call with me here or email me at info@indfin.com.

___________________________

*Generally limited to children and grandchildren of current IFG clients.

**Applies to IFG planning and advisory services only. Fees do not include advice on assets not covered under an advisory agreement, or third party fees or expenses which may be charged for custodial, management, or reporting by other third party providers. This schedule does not include or apply to compensation for assets placed in insurance products required to fulfill a plan. Annual fees are deducted on a quarterly basis by the asset custodian according to the schedule(s) outlined in the proposal and platform provider’s fee agreement(s). Clients engaged prior to January 2, 2021 may be paying fees that differ from this schedule for the same services. IFG’s ADV filing is available upon request. All fees are subject to change without prior notice. However, clients must sign amendments to any agreements impacted by the fee changes.