When Should You Apply for Social Security Benefits?

Mistakes can be costly – and may be permanent!

Mistakes can be costly – and may be permanent!

The value of ESG – or even what it is – hasn’t been defined. So, it depends on who you ask, how the law is interpreted, and apparently, who’s doing the packaging. Oh, yes, it also depends on how you quantify it.

How about an asset class that doesn’t have the risks of stocks or bonds? One that can provide stability and peace of mind.

True! Market losses aren’t all yours. The IRS subsidizes part of them.

For some people, planning for retirement can feel like trying to eat an elephant; but, it doesn’t have to be that way. Before making big decisions, it’s always important to get the ducks lined-up first.

Have you tried to call Social Security lately? If so, this won’t come as much of a surprise – customer service is all but non-existent.

RMD age hikes may not be the blessing you think. The question just might be who is more secure? Retirees or future government spending?

Managing inherited money isn’t as simple as depositing the check and picking some sure-fire investments.

Retirement decisions can be momentous. Which year you would have remembered would depend on if you retired back then… and which year!

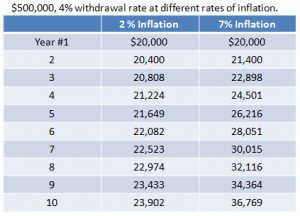

No investment strategy is without some kind of risk; but, I think this comes close. Take a look:

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.

The Big Picture:

For years, baby boomers drove the housing market, and much of the economy, as they moved into their first homes, began raising families, and moved-up to larger homes finally ending-up in the “McMansions” we’re all familiar with today. The boomers are now older—they’re no longer moving up. In fact, they’re just beginning to “decumulate” and downsize.