What You Should Know About The SECURE Act!

The SECURE Act contains quite a few changes that impact both individuals and business owners.

The SECURE Act contains quite a few changes that impact both individuals and business owners.

Typically, small business owners are the active managers of their businesses, are heavily invested in their businesses, and generally rely on a small number of important accounts and suppliers. Also, in most, if not all, cases no secondary market exists for easy valuation and quick disposition of ownership.

Few people think about this – and I wish I could be the smart guy that thought of this for this post, but I wasn’t . It’s something called the widow’s penalty tax; it affects the surviving spouse.

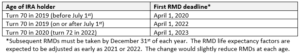

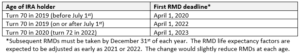

Congratulations—you’ve built up a healthy retirement nest egg, maybe even a couple million bucks in a traditional IRA. Cue the applause! No worry about tax traps now! But as you reach retirement and start thinking about how to spend it (or pass it on), Uncle Sam is waiting with a few surprise moves that could mess with your plans. These are the tax traps.

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.