Changing Jobs? You May Have an Important Decision to Make!

What to do with your money in an employer-sponsored retirement plan, such as a 401(k) plan? Since these funds were originally intended to help provide

What to do with your money in an employer-sponsored retirement plan, such as a 401(k) plan? Since these funds were originally intended to help provide

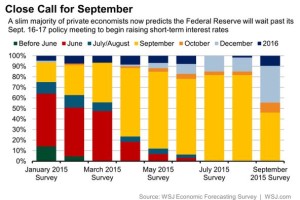

A slim majority of economists don’t believe they will. We’ll soon see if these ‘experts’ are right.

Jim Lorenzen, CFP®, AIF® Retirement successmaynot be as easy to achieve as many think.I attended a conference and heard one speaker relay a story about

You’ve just inherited an IRA from someone not your spouse… usually a parent. Guess what! Your rules are different.

If you’ve changed jobs or are getting ready to retire, don’t leave your old retirement account behind. Rolling over your employer-sponsored plan—like a 401(k) or 403(b)—into an IRA or new employer’s plan keeps your money growing tax-deferred and gives you more control over your investments.