Econ. 101-Supply and Demand – and Longevity Credits

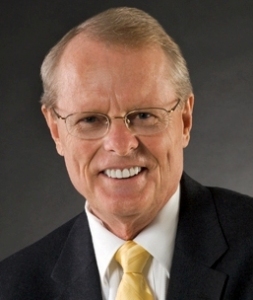

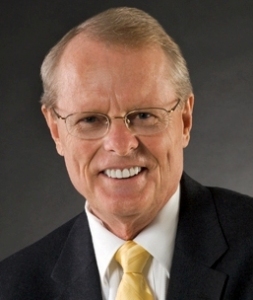

Jim Lorenzen, CFP®, AIF® More and more boomers are beginning to approach retirement. No news there; but something’s been happening – and continues to happen

Jim Lorenzen, CFP®, AIF® More and more boomers are beginning to approach retirement. No news there; but something’s been happening – and continues to happen

Jim Lorenzen, CFP®, AIF® When I first entered the advisory business in the early 1990s, financial entertainment television was a new phenomenon. All the tv

Jim Lorenzen, CFP®, AIF® For some, managing a large inheritance can be as daunting as winning the lottery; the windfall may sound good initially, but

Whether you live locally in Moorpark, Simi Valley, or anywhere else, you may want to consider having a trusted fiduciary financial advisor help with your mid-year review, as you may see.

While the Fed continues to target a 2.0% inflation rate, headwinds in the form of inflation pressures from worker shortages, tariffs, and foreign conflicts are coming at a time as America approaches a historic demographic milestone – a record number of individuals turning 65 this year.